Featured

Table of Contents

- – The Best Guide To Actual Stories from People W...

- – Some Known Factual Statements About Bankruptcy...

- – The 3-Minute Rule for Initial Effects of Pers...

- – Some Known Incorrect Statements About Creatin...

- – The Single Strategy To Use For Does Why Ment...

- – The How Much Debt Counseling Usually Charge ...

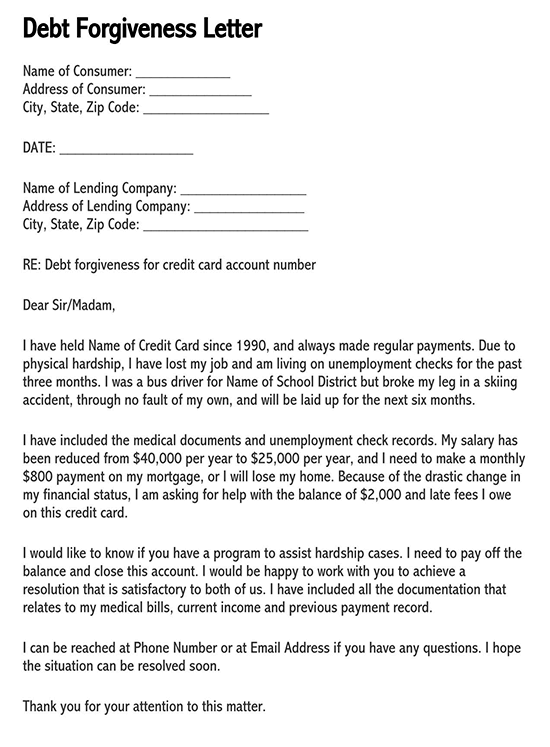

Applying for credit scores card financial debt mercy is not as straightforward as requesting your equilibrium be erased. Financial institutions do not readily offer financial obligation forgiveness, so comprehending just how to present your situation efficiently can boost your opportunities.

I would love to review any choices readily available for lowering or resolving my financial debt." Financial obligation forgiveness is not an automatic option; in most cases, you need to bargain with your financial institutions to have a part of your equilibrium decreased. Charge card firms are usually open up to settlements or partial forgiveness if they think it is their ideal opportunity to recuperate some of the cash owed.

The Best Guide To Actual Stories from People Who Secured Peace of Mind

If they offer full mercy, obtain the arrangement in creating before you approve. You could require to submit an official created demand explaining your hardship and just how much forgiveness you need and give documents (see next section). To negotiate successfully, try to comprehend the financial institutions placement and use that to offer a solid instance regarding why they must function with you.

Constantly guarantee you receive confirmation of any kind of forgiveness, negotiation, or difficulty strategy in creating. Creditors may supply less alleviation than you need.

Debt forgiveness involves legal factors to consider that consumers must be mindful of before continuing. The complying with federal laws assist safeguard consumers looking for debt forgiveness: Restricts harassment and abusive debt collection techniques.

Some Known Factual Statements About Bankruptcy Essentials and Eligibility

Needs creditors to. Guarantees equalities in loaning and repayment negotiations. Limitations costs and avoids sudden rate of interest walks. Needs clear disclosure of repayment terms. Prohibits financial debt negotiation firms from charging in advance costs. Requires business to reveal success rates and possible dangers. Understanding these protections helps stay clear of rip-offs and unjust creditor practices.

Making a repayment or also acknowledging the debt can reactivate this clock. Even if a financial institution "charges off" or writes off a financial obligation, it doesn't indicate the financial debt is forgiven.

The 3-Minute Rule for Initial Effects of Personal Credit Rating

Before accepting any kind of payment strategy, it's an excellent idea to examine the statute of constraints in your state. Legal effects of having financial obligation forgivenWhile financial obligation forgiveness can alleviate financial concern, it comes with potential legal consequences: The internal revenue service treats forgiven financial debt over $600 as taxed earnings. Debtors get a 1099-C type and should report the amount when declaring tax obligations.

Here are some of the exemptions and exemptions: If you were insolvent (suggesting your total debts were above your overall properties) at the time of forgiveness, you might exclude some or all of the terminated financial obligation from your taxable revenue. You will certainly require to submit Kind 982 and affix it to your tax return.

While not connected to bank card, some pupil funding mercy programs permit financial debts to be canceled without tax repercussions. If the forgiven financial obligation was connected to a certified farm or business operation, there may be tax exemptions. If you don't get approved for financial obligation mercy, there are different financial debt alleviation strategies that may function for your scenario.

Some Known Incorrect Statements About Creating Your Custom Journey to Freedom

You get a new finance large enough to repay all your existing charge card equilibriums. If authorized, you utilize the new funding to repay your bank card, leaving you with just one regular monthly repayment on the debt consolidation finance. This streamlines financial debt administration and can save you cash on interest.

Crucially, the firm negotiates with your financial institutions to lower your passion prices, substantially reducing your total financial debt worry. They are a terrific financial debt option for those with inadequate credit scores.

Allow's encounter it, after several years of higher prices, money doesn't reach it made use of to. About 67% of Americans say they're living income to paycheck, according to a 2025 PNC Bank study, which makes it difficult to pay for financial debt. That's specifically real if you're bring a big financial obligation equilibrium.

The Single Strategy To Use For Does Why Mental Health Support for Veterans Matters More Than Ever Work for Everyone

Combination loans, debt administration plans and repayment strategies are some techniques you can make use of to decrease your financial obligation. Yet if you're experiencing a significant economic hardship and you've exhausted other alternatives, you might have a look at financial obligation forgiveness. Debt mercy is when a loan provider forgives all or a few of your superior equilibrium on a car loan or other credit account to aid soothe your debt.

Financial obligation forgiveness is when a lending institution accepts eliminate some or all of your account balance. It's an approach some people utilize to minimize debts such as bank card, individual loans and pupil finances. Secured debts like home and auto loan generally do not certify, since the lending institution can recover losses by taking the security with foreclosure or repossession.

Federal pupil loan forgiveness programs are among the only methods to clear a financial debt without effects. These programs apply just to government student car loans and commonly have rigorous qualification policies. Exclusive pupil car loans do not get mercy programs. The most popular option is Civil service Loan Forgiveness (PSLF), which wipes out continuing to be government funding balances after you work full-time for a qualified company and make settlements for one decade.

The How Much Debt Counseling Usually Charge Ideas

That implies any not-for-profit medical facility you owe may be able to provide you with financial obligation relief. Majority of all united state health centers offer some kind of medical financial debt relief, according to individual services support group Buck For, not simply not-for-profit ones. These programs, often called charity treatment, lower or perhaps get rid of clinical expenses for qualified patients.

Table of Contents

- – The Best Guide To Actual Stories from People W...

- – Some Known Factual Statements About Bankruptcy...

- – The 3-Minute Rule for Initial Effects of Pers...

- – Some Known Incorrect Statements About Creatin...

- – The Single Strategy To Use For Does Why Ment...

- – The How Much Debt Counseling Usually Charge ...

Latest Posts

First Meeting with APFSC - Truths

Some Known Incorrect Statements About New Legislation That Will Transform Bankruptcy Availability

9 Easy Facts About How What to Do When You Can't Pay Your Income Taxes: A Complete Financial Recovery Guide : APFSC Preserves What You've Earned Shown

More

Latest Posts

First Meeting with APFSC - Truths

Some Known Incorrect Statements About New Legislation That Will Transform Bankruptcy Availability